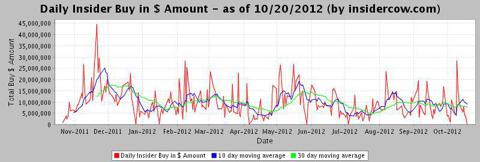

A good investment strategy can

be buying shares that the insiders have just bought recently. However, a

better option could be that these companies offer a dividend to its

investors. The insider trading is produced by executives and directors

who have the most up-to-date information on their companies' prospects.

Intimately acquainted with cyclical trends, order flow, supply and

production bottlenecks, costs and other key ingredients of business...