A good investment strategy can

be buying shares that the insiders have just bought recently. However, a

better option could be that these companies offer a dividend to its

investors. The insider trading is produced by executives and directors

who have the most up-to-date information on their companies' prospects.

Intimately acquainted with cyclical trends, order flow, supply and

production bottlenecks, costs and other key ingredients of business

success, these insiders are way ahead of analysts and portfolio

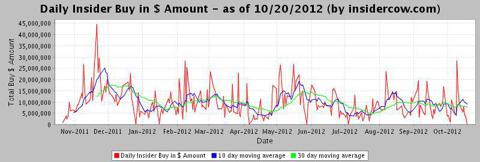

managers, not to mention individual investors. In the next chart, we can

see the influence of the insiders in the prices of the companies and

the variations in their quotes.

(click to enlarge)

(Source)

(Source)

Insiders' purchases may cause an increase in the prices of shares as you have seen in the top chart. So, in this article, I will write about three dividend stocks that insiders bought last week and deserve to be considered.

National American University Holdings Inc (NAUH)

This company reported a dividend of $0.16 or the equivalent of a 3.90%. Insiders have started to snap up shares in National American University Holdings. This company engages in the ownership and operation of National American University (NAU) that provides post-secondary education services primarily for working adults and other non-traditional students in the United States.

National American University has a market cap of $101.53 million and an enterprise value of $84.20 million. Its trailing P/E is 20.89, and its forward P/E is just 8.82. National American University's estimated growth rate for this year is -50.45. It has a total cash position on its balance sheet of just $27.83 million, and its total debt is at $10.49 million.

Ronald L. Shape, CEO of National American University, has just bought 2,000 shares, or $8,200 worth of stock, at $4.2 per share.

From a technical standpoint, this stock is currently trading below both its 50-day and 200-day moving averages, which is bearish. This stock plunged from its January high of $8.8 to a recent low in May of $3.48. If you are bullish on this stock, I would look to be a buyer on the next high-volume move above some near-term overhead resistance at $4.06 a share. Look for volume that's tracking in close to or above its three-month average action of 25,895 shares.

Valhi Inc (VHI)

Valhi Inc reported a dividend of $0.20 or the equivalent of a 1.60%. Insiders have started to snap up shares in Valhi Inc. The Company operates in the chemicals, component products, and waste management businesses. The company'’s chemicals segment produces and markets titanium dioxide pigment, a white inorganic pigment used to impart whiteness, brightness, opacity, and durability for applications, such as coatings, plastics, paper, inks, food, and cosmetics.

Valhi has a market cap of $4.07 Billion and an enterprise value of $5.49 Billion. This stock trades at a cheap valuation. Its trailing P/E is 15.78, and its forward P/E is just 23.51. Valhi's estimated growth rate for this year is 352.42%. It has a total cash position on its balance sheet of just $104 million, and its total debt is at $863.80 million.

Harold C. Simmons, Chairman of the Board, has just bought 4,000 shares, or $48,800 worth of stock, at $12.2 per share.

From a technical standpoint, this stock is currently trading below both its 50-day and 200-day moving averages, which is bearish. This stock plunged from its December, 2011 high of $21.69 to a recent low in July of $10.67. If you are bullish on this stock, I would look to be a buyer on the next high-volume move above some near-term overhead resistance at $12.36 a share. Look for volume that's tracking in close to or above its three-month average action of 26,655 shares.

Bank of South Carolina Corporation (BKSC)

Bank of South Carolina Corporation reported a dividend of $0.44 or the equivalent of a 3.70%. Insiders have started to snap up shares in Bank of South Carolina Corporation. This bank operates as the holding company for The Bank of South Carolina that provides commercial banking products and services to individuals, and small and medium-sized businesses in South Carolina.

Bank of SC has a market cap of $52.91 million and an enterprise value of $16.42 million. Its trailing P/E is 14.87, and its forward P/E is just incalculable. Bank of South Carolina's estimated growth rate for this year is 1.98%. It has a total cash position on its balance sheet of just $36.49 million, and its total debt is at $0.

Sheryl G. Sharry, CFO of Bank of South Carolina, has just bought 2,000 shares, or $22,900 worth of stock, at $11.45 per share.

From a technical standpoint, this stock is currently trading above both its 50-day and 200-day moving averages, which is bullish. This stock plunged from its July high of $12.50 to a recent low in October of $10.85. If you are bullish on this stock, I would look to be a buyer on the next high-volume move above some near-term overhead resistance at $11.9 a share. Look for volume that's tracking in close to or above its three-month average action of 2,520 shares.

*Chart data sourced from finviz.com, all other data sourced from yahoo.com as well as the webs of the previously mentioned companies.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it . I have no business relationship with any company whose stock is mentioned in this article.

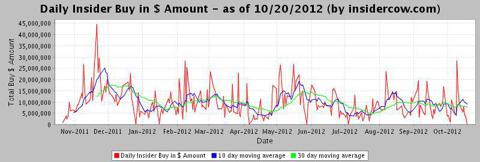

(click to enlarge)

(Source)

(Source)Insiders' purchases may cause an increase in the prices of shares as you have seen in the top chart. So, in this article, I will write about three dividend stocks that insiders bought last week and deserve to be considered.

National American University Holdings Inc (NAUH)

This company reported a dividend of $0.16 or the equivalent of a 3.90%. Insiders have started to snap up shares in National American University Holdings. This company engages in the ownership and operation of National American University (NAU) that provides post-secondary education services primarily for working adults and other non-traditional students in the United States.

National American University has a market cap of $101.53 million and an enterprise value of $84.20 million. Its trailing P/E is 20.89, and its forward P/E is just 8.82. National American University's estimated growth rate for this year is -50.45. It has a total cash position on its balance sheet of just $27.83 million, and its total debt is at $10.49 million.

Ronald L. Shape, CEO of National American University, has just bought 2,000 shares, or $8,200 worth of stock, at $4.2 per share.

From a technical standpoint, this stock is currently trading below both its 50-day and 200-day moving averages, which is bearish. This stock plunged from its January high of $8.8 to a recent low in May of $3.48. If you are bullish on this stock, I would look to be a buyer on the next high-volume move above some near-term overhead resistance at $4.06 a share. Look for volume that's tracking in close to or above its three-month average action of 25,895 shares.

Valhi Inc (VHI)

Valhi Inc reported a dividend of $0.20 or the equivalent of a 1.60%. Insiders have started to snap up shares in Valhi Inc. The Company operates in the chemicals, component products, and waste management businesses. The company'’s chemicals segment produces and markets titanium dioxide pigment, a white inorganic pigment used to impart whiteness, brightness, opacity, and durability for applications, such as coatings, plastics, paper, inks, food, and cosmetics.

Valhi has a market cap of $4.07 Billion and an enterprise value of $5.49 Billion. This stock trades at a cheap valuation. Its trailing P/E is 15.78, and its forward P/E is just 23.51. Valhi's estimated growth rate for this year is 352.42%. It has a total cash position on its balance sheet of just $104 million, and its total debt is at $863.80 million.

Harold C. Simmons, Chairman of the Board, has just bought 4,000 shares, or $48,800 worth of stock, at $12.2 per share.

From a technical standpoint, this stock is currently trading below both its 50-day and 200-day moving averages, which is bearish. This stock plunged from its December, 2011 high of $21.69 to a recent low in July of $10.67. If you are bullish on this stock, I would look to be a buyer on the next high-volume move above some near-term overhead resistance at $12.36 a share. Look for volume that's tracking in close to or above its three-month average action of 26,655 shares.

Bank of South Carolina Corporation (BKSC)

Bank of South Carolina Corporation reported a dividend of $0.44 or the equivalent of a 3.70%. Insiders have started to snap up shares in Bank of South Carolina Corporation. This bank operates as the holding company for The Bank of South Carolina that provides commercial banking products and services to individuals, and small and medium-sized businesses in South Carolina.

Bank of SC has a market cap of $52.91 million and an enterprise value of $16.42 million. Its trailing P/E is 14.87, and its forward P/E is just incalculable. Bank of South Carolina's estimated growth rate for this year is 1.98%. It has a total cash position on its balance sheet of just $36.49 million, and its total debt is at $0.

Sheryl G. Sharry, CFO of Bank of South Carolina, has just bought 2,000 shares, or $22,900 worth of stock, at $11.45 per share.

From a technical standpoint, this stock is currently trading above both its 50-day and 200-day moving averages, which is bullish. This stock plunged from its July high of $12.50 to a recent low in October of $10.85. If you are bullish on this stock, I would look to be a buyer on the next high-volume move above some near-term overhead resistance at $11.9 a share. Look for volume that's tracking in close to or above its three-month average action of 2,520 shares.

*Chart data sourced from finviz.com, all other data sourced from yahoo.com as well as the webs of the previously mentioned companies.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it . I have no business relationship with any company whose stock is mentioned in this article.

1 comentarios:

The price difference of the shares becomes more noticeable with considering such statistics. It seems to me that these dividends will be more profitable.

Post a Comment